charitable gift annuity canada

Web A charitable gift annuity is a type of planned-giving arrangement between a donor and a nonprofit organization. The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor.

Donor Advised Fund Edward Jones

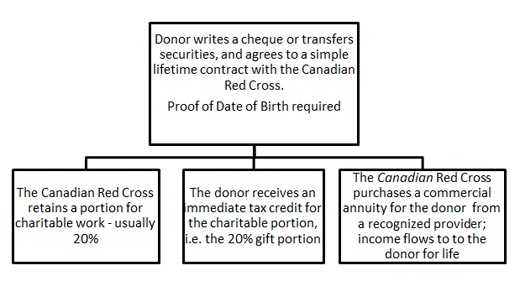

Web Additionally you will receive a charitable tax receipt for the gift portion of the payment.

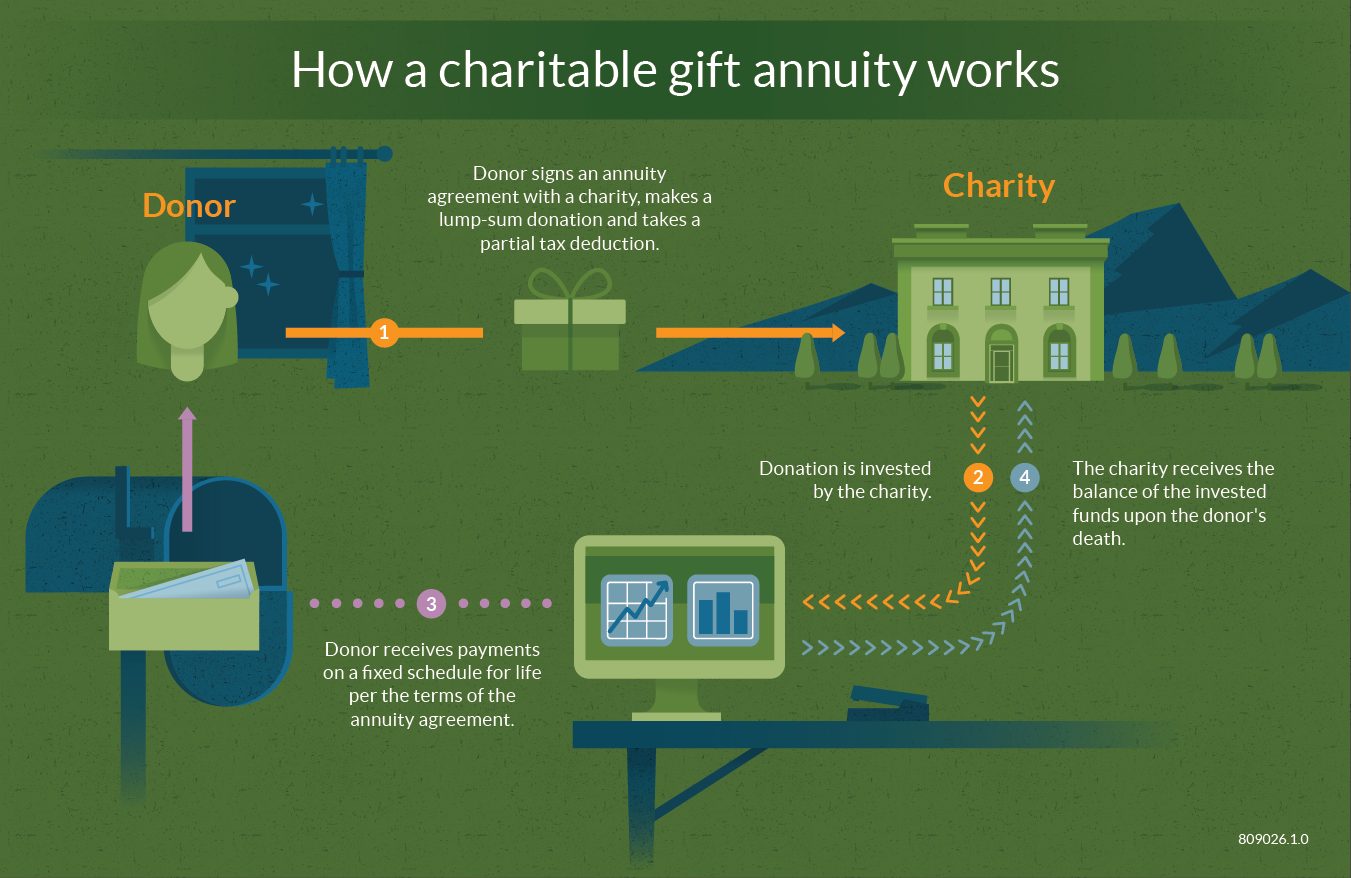

. Web Charitable Gift Annuities are giving vehicles that offer the same income security as GICs or other fixed income investments but with better cash flow. The donor receives a regular payment for life based. Web Starting with a minimum gift of 10000 that can be funded with cash or other valuable property such as stocks a charitable gift annuity is established with the.

You can discuss this confidentially by. The gift is invested in our investment pool generating an. Web Canadian Charitable Annuities Association CCAA The CCAA provides education information and guidance to charities registered under the Income Tax Act of Canada.

A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. Web A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. Web In a nutshell a Charitable Gift Annuity is a contract that provides the donor a fixed income stream for life in exchange for a substantial donation to a charity.

Web To qualify as a charitable gift annuity a minimum of 20 of the principal amount of the annuity must be a charitable gift. An annuity is simply a term that means a series of payments made. Web A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor.

Let us help you get started. Web In essence Charitable Gift Annuities can be considered part investment and part charitable gift. Web At the end of life the remainder of your annuity capital becomes a gift for your favourite charities.

Web One widely overlooked strategy deserves special attention from generous baby boomers and other individuals who want to reduce their taxes -- make a significant gift to a charity. Web When you donate a capital sum of money into a Gift Annuity with Link Charity you trigger three events simultaneously. Web Gift Funds Canada - the Charitable Gift Funds Canada Foundation is a registered public charitable foundation that helps individuals realize their philanthropic goals meaningfully.

Benefits of a Charitable Gift Annuity. Example of how a charitable gift annuity for an 80-year-old works. Web The Canadian Revenue Agency CRA treats all or part of annuity income as a return of capital offering the donor access to greater monthly income than would.

Web In essence Charitable Gift Annuities can be considered part investment and part charitable gift. An annuity is simply a term that means a series of payments made at. If you make an.

Web Give a thoughtful gift that gives back. It is a thoughtful gift that gives back.

Charitable Gift Annuities Studentreach

Charitable Gift Annuities Give Green Canada

Give Green Canada Introduction To Charitable Gift Annuities

Home Charitable Giving Link Charity

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Giftfunds Canada What To Know About Charitable Gift Annuity Rates

8 Types Of Planned Gifts Your Nonprofit Should Know

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

What Is A Charitable Gift Annuity Fidelity Charitable

Charitable Gift Annuities Canadian Red Cross

Charitable Gift Annuities Making A Rebound The Nonprofit Times

Support Our Mission Giving Benefits Bishop Gadsden

Giftfunds Canada Tax Advantages Of A Charitable Gift Annuity

Charitable Gift Annuities Give To Ualberta

Committee Spotlight Cga Canadian Committees Compressed Gas Association

Uja Federation Of New York Planned Giving Charitable Gift Annuity